Introducing Saving Tool Advanced

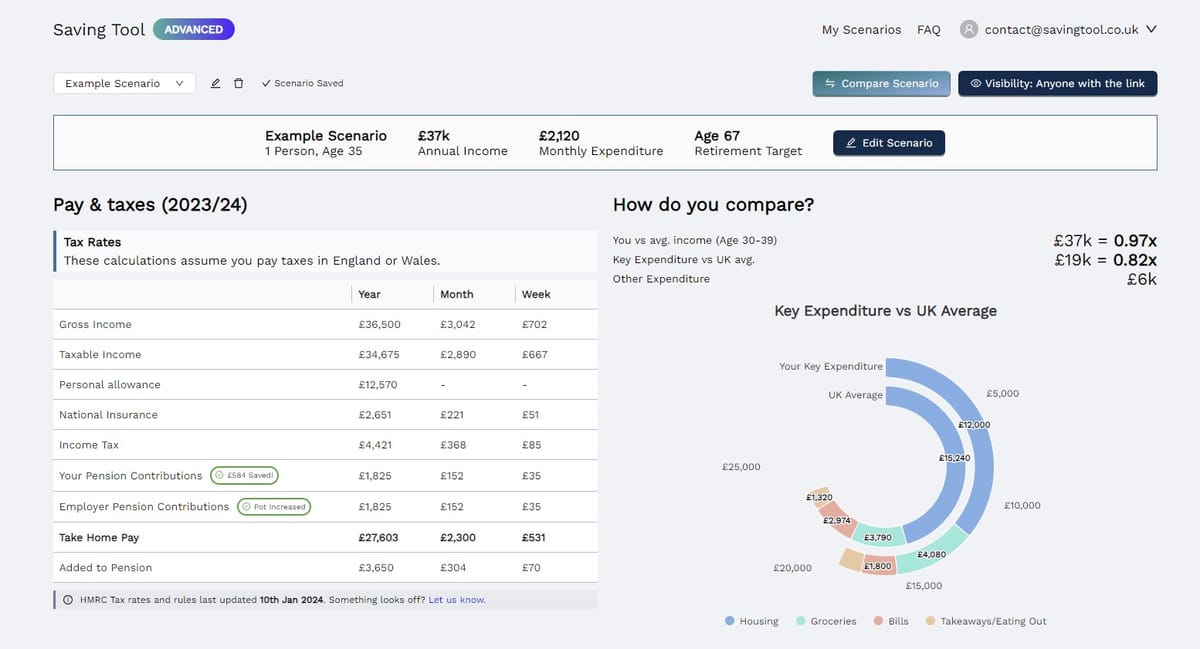

Saving Tool Advanced is a new tool that builds on the foundations of Saving Tool UK. It delivers substantially improved detail and deeper insights thanks to a redesigned input and simulation system, making it the UK's most comprehensive personal finance tool.

The Saving Tool Advanced simulation accepts around 10x more parameters and generates much more detailed outcomes than its predecessor. It's specifically built to understand all the complexities and nuances related to the UK tax system, including UK-specific personal finance mechanisms like Individual Savings Accounts (ISAs), General Investment Accounts (GIAs), Capital Gains and different types of pensions.

Still Simple to Use

Saving Tool Advanced's simulation works purely based on the inputs you provide. It does not import transactions or connect to any bank, broker, investment or other accounts.

With Saving Tool Advanced, there is no requirement to spend hours sifting through the complexities and chaos of current account transactions. Getting started takes 30 seconds: sign in, create a scenario, provide a few inputs and start experimenting.

What's New?

Specify Windfalls and Liabilities

Expecting an outlay in the future, like a new car or some home improvement? Saving Tool Advanced introduces a concept of Liabilities: define a date, pick One-Off or Monthly Finance, specify how much you expect it to cost, then the simulation will factor this in.

Perhaps you're expecting some extra income in the future, like a Capital Gain, insurance payout or gift? Specify an expected Windfall in your scenario. Like Liabilities, the windfall will automatically be included in the simulation.

Add a Partner

Saving Tool Advanced allows you to add a partner to a scenario. Have a shared mortgage, car or other asset? Convert a Liability to a Shared Liability and decide how the payments are split:

- 50/50 based on the cost of the liability.

- 50/50 based on comparing your pre-tax incomes.

- 50/50 based on comparing your post-tax incomes.

- A totally custom split that you've agreed.

Pension Support Expanded

Whereas the existing tool only supports Defined Contribution (DC) pensions, Saving Tool Advanced also supports Defined Benefit (DB) pensions, amongst various other pension-related enhancements.

New pension features:

- Support added for DB Pensions, including specifying thresholds/caps and/or Additional Voluntary Contributions (AVCs).

- Ability to define contribution type for DC pensions (Salary Sacrifice, Net Pay, or Relief at Source).

- Ability to define employee contributions and employer contributions as absolute £ amounts or % amounts.

- Ability to define Pensionable Income for more complex contribution situations.

Compare Scenarios

A new Compare Scenario view allows you to directly contrast two different scenarios. This enables speculating across different potential possibilities: factoring in potential changes in income, expenses and circumstances.

Looking at a potential job change? Moving home? Moving in together? Create multiple scenarios to understand the possibilities. Get accurate and detailed information that factors in everything, including taxes.

Share Scenarios

All scenarios are private by default, but you can optionally make them public to share. Once made public, anyone can view a scenario using the link.

You can view a sample Scenario here.

Work Offline for Enhanced Privacy

If you're privacy minded, you can still enjoy all the features of Saving Tool Advanced using an Offline Scenario (except for Compare Scenarios). This allows you to work with a local file. No scenario data is uploaded to our servers when using this mode, meaning you can keep your scenario information completely offline.

New Visualisations and Insights

Each year of the simulation can be viewed through new visualisations and charts, such as insights on available income, consumed income and effective tax rates.

A novel Simulation Breakdown by Year table is also available for closer inspection of each year, allowing you to understand each step of the simulation.

Better Support for Bonuses

Bonuses can now be defined in alternative ways depending on how you or your employer apply pension contributions to them. The simplest solution is to define a Pensionable Salary amount under Workplace Pension, meaning only a certain amount of income will have pension contributions applied.

This feature is also helpful for higher earners who are affected by pension tapering. For more information, see the Saving Tool Advanced FAQ.

Better Support for Student Loans

Student Loan plans 3 and 4 are now supported, as are postgraduate loans. The simulation will also apply student loan interest (and loan repayments) during each year, plus cancel loans after 30 years.

Simple Approach

The Saving Tool Default Strategy uses a simple approach: it assumes that any surplus income (i.e. income that you are left with after covering all your expenditure, each year) is invested into an Stocks and Shares (S&S) ISA, up to the £20k Annual Allowance. Any further surplus beyond this amount is invested into a taxable GIA.

The strategy assumes a typical level of growth based on historical returns for global equity index funds. Sign in and create a scenario to learn more.

Try Saving Tool Advanced Now

Saving Tool Advanced is a premium version of Saving Tool UK offered through low-cost, flexible subscription options. All users get a free trial for 1 month with all features available, except comparing scenarios. For a full list of pricing options, visit this link.

The new tool is crafted to meet the needs of anyone curious about understanding and optimising their personal finance. It's a suitable companion for both seasoned finance enthusiasts and newcomers who are ready to take a deeper dive into their financial planning.

The existing Saving Tool UK website will permanently remain a free tool that will continue to offer a take-home pay, pension and savings snapshot.

Join the New Saving Tool Community

Interested in how the tool works? Want to provide feedback, or discuss ideas? Get involved by joining the Discord server or emailing us.