Putting your money to work in 2023: Which investments make the most sense for UK investors?

Investing is not just for the wealthy or financial experts. With the right knowledge and resources, anyone can become an investor and put their savings to work. Whether you're looking to achieve a specific goal, secure your financial future, or simply put your idle funds to use, investing funds over keeping them in a low or zero interest cash account is likely to be a rewarding choice.

Defeating Inflation

Inflation is the enemy that slowly erodes the value of your hard-earned savings, and with inflation exceeding 11% in the UK towards the end of 2022, it’s more important than ever to understand the options you have. As a crude example, if 11% inflation lasted for 1 year, £1000 saved as cash (zero interest) at the start of the year has the purchasing power of just £890 at the end of the year.

It’s fair to say that 11% is unusually high, and is way out of whack with many of the preceding years before 2022 in the UK - as a general rule, it’s reasonable to assume inflation will be more like 2.5% per year. Also, both the Bank of England and the U.S. Federal Reserve have inflation targets of 2%.

So, to ensure your £1,000 still has £1,000 purchasing power after 1 year, you’ll need your cash to grow by 2.5%. In other words, you’ll want to either invest it, or gain enough interest such that you end up with £1,025.

Popular Investments

Two of the most popular and accessible investment options are high-interest cash accounts and stocks and shares (S&S) accounts. There are many vehicles and incentives available to invest your cash, particularly with S&S accounts. In recent years, S&S investment accounts (particularly S&S ISAs and SIPPs) have been growing in popularity, but due to higher central bank interest rates in 2022/23, high-interest cash accounts have become a viable alternative.

Stocks and shares ISAs allow you to invest in a variety of different stocks and shares, and index funds are a type of investment that tracks the performance of a particular stock market index, such as the S&P 500. These types of investments are designed to be passive and provide exposure to a very broad market, and should not be confused with active trading, where stocks and shares are individually picked and timed. Many investors opt for this technique, and it is very similar to how many pension schemes work.

High-interest cash accounts are much simpler: you agree to a set of simple terms in exchange for a fixed rate of return over a certain period. With rates currently exceeding 4%, this beats typical inflation (but not the current rate of inflation). Although returns with cash accounts are usually lower, the risk level is much lower - investors are getting a predictable and safe return and are usually not exposed to financial markets during the term of the investment.

Other forms of financial investment opportunities exist in the UK, such as SEIS/EIS, VCTs, but these are typically for experienced or specialist investors and are not recommended for the everyday investor.

Exploring the options

So, what does this look like in practice? Here we’ll take a look at 4 example scenarios. Note that, the performance of all the investments does not change depending on how much you have to invest, although the impact of fees can have affect (for example, some ISA providers charge a portfolio % annual fee, but this could be capped meaning that investors with a higher principal investment could pay relatively less than those with a smaller principal investment).

| Principal | Investment | Annual return | After 2 years | Total Returns | After 5 years | Total Returns |

|---|---|---|---|---|---|---|

| £2,500 | Cash account example A | 3.40% | £2,670 (+£170) | 6.80% | £2,925 (+£425) | 17.00% |

| £2,500 | Cash account example B | 4.17% | £2,709 (+£209) | 8.34% | £3,021 (+£521) | 20.85% |

| £2,500 | Index fund A (lower risk) | 7% | £2,875 (+£375) | 14.98% | £3,544 (+£1,044) | 41.76% |

| £2,500 | Index fund B (higher risk) | 11% | £3,112 (+£612) | 24.48% | £4,322 (+£1,822) | 72.89% |

How do I know what is a good return?

Good returns can be subjective, but here we’ve defined a rough guide for the everyday investor. As a starting point, we know that approximately 2.5% a year is flat (i.e. matching typical inflation): anything less than this, you’re in the red, anything more - you’re in the black.

| Return over 1 year | Performance |

|---|---|

| <2.5% | Poor - losing value |

| 2.5% | Flat - keeping the same value |

| 2.5% to 5% | Moderate |

| 5% to 10% | Good |

| 10% to 20% | Very good |

| >20% | Exceptional |

As these examples demonstrate, unsurprisingly, higher risk options can yield higher returns - but lower risk cash accounts have something to offer and should not be dismissed.

If maximum returns is your goal and you can invest for more than a year, S&S accounts are likely to be the investment for you thanks to the upside of compounding returns, where investment returns are continuously re-invested. However, if you want something shorter term - or something with a higher degree of certainty that allows you to precisely manage your investments, high-interest cash accounts could be the best option.

Issues with cash accounts

It is important to consider that current central bank interest rates are currently “unusually” high; they have been increased globally in response to unusually high inflation levels. Both the Bank of England and U.S. Federal Reserve have inflation targets of 2% and have opted to increase interest rates, hence the competitive rates we see today. Should these rates reduce, for example back down to 0.5% (last seen in mid-2018 prior to just 0.1% during the covid era), cash savings accounts are likely to drop in value and appeal significantly. Experts are currently expecting rates to begin reducing towards the 2nd half of 2023 and beyond, so this should be taken into consideration by investors. It should be noted that any fixed-term deals that you enter into will still be valid no matter what happens with interest rates - in fact, when you enter such a deal, the bank has usually priced in their expectations of the market when offering you a rate.

Another issue to contend with is that the best rates are often offered with the requirement of locking away your money or long withdrawal times, which is impractical - especially if your needs or goals change. More flexible accounts are available (with lower withdrawal or minimum investment timelines) but usually come with the trade-off of much lower investment limits.

If you do decide that a cash account meets your goals, be sure to shop around, as many providers exist and there are dozens of options with varying rates and terms.

As a very broad rule-of-thumb, a medium risk global index fund should typically achieve something around 7.5% (Good) per year in the long run, which gives you 5% over inflation.

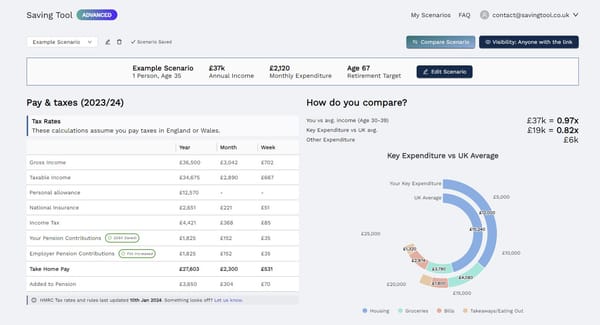

The SavingTool.co.uk simulation uses these numbers when speculating where your surplus cash could go.

Tax efficiencies matter

There are tax efficient wrappers in the UK for both S&S investments and cash accounts. There are several types of personal ISAs.

Depending on your income, using tax efficient wrappers is critical to maximising your investments. The value of tax savings can significantly increase your ultimate return on investment. Check the SavingTool.co.uk simulation which uses S&S ISA investments as the primary method of growing wealth (after pensions).

Various providers are available and you should do your research to understand what each platform offers. It’s important to understand the fees that each platform charges (and don’t forget that platform fees are often separate from individual fund fees). Popular providers include Vanguard, Hargreaves Lansdown, Interactive Investor and Nutmeg. Popular high street banks are also increasingly offering their own products to current account holders, so this could also be an option for you.

See where you can go

If you haven’t already, give the SavingTool.co.uk tool a spin to see how you could stand to gain from becoming an everyday investor.

Remember that you should only ever invest what you can afford to, and always be aware of the risks when investing.