Pension Planning 101: The Importance of Starting Early and Maximizing Contributions

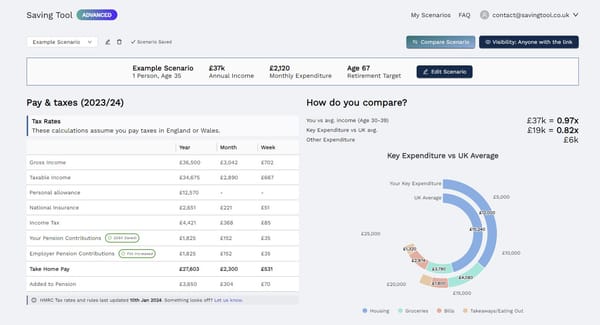

Paying into a defined contribution pension plan earlier in life can reap significant rewards in the long term, and on SavingTool.co.uk, you can test out your own scenarios to see how much you could benefit.

Starting to pay into a pension plan at a younger age means that your money has more time to grow, which can lead to a larger retirement fund. For example, if you begin paying into a pension at age 25 with a salary of £40,000, you make contributions of 5% of your salary every year, matched by your employer, you could have a retirement fund worth more than £468,000 by the time you reach age 67. However, if you wait until age 35 to start making contributions with the same salary and contribution rate, your retirement fund would only be around £265,000 by age 67 – a difference of £203,000.

Of course, it’s not just the timing of when you start contributing that can make a difference – the level of your contributions also plays a role. Using the same example, contributing 10% (but still receiving 5% from your employer) from age 25 could result in a pot of £702,000 - an increase of £234,000 despite only an additional £84,000 in contributions over 42 years, thanks to the benefits of compounding. Starting at age 35 and contributing 10% could lead to a fund of £398,000 - about £133,000 better off.

It’s not just the advantage of compounding that matters when it comes to increasing your contributions: assuming an income under £200,000, pension contributions benefit from tax relief. This means that the government will effectively add extra money to your contributions.

For basic rate taxpayers, the government will add 20% tax relief to your contributions. So, if you were to contribute £800 to your pension plan, the government would add an extra £200, bringing your total contribution to £1,000. Higher rate taxpayers can claim back an additional 20% through their tax return.

For example, consider an individual who earns £40,000 per year, and is in the basic rate tax bracket, who increases her contributions from 5% to 10% of her salary. If she starts contributing at age 25, her total contributions will be £4,000 per year, and the government will add an additional £800 per year, this would increase her retirement fund by £48,000 over 42 years (age 25 to 67).

Additionally, contributions made to a pension plan are not subject to National Insurance contributions. This means that the amount you pay into your pension is not subject to the 12% employee and 2% employer contributions, which can add up to significant savings over time.

It's important to note that pension contributions do have limits, known as annual and lifetime allowance. The annual allowance is the maximum amount you can pay into your pension and still receive tax relief, currently set at £40,000 per year (2022-2023). Lifetime allowance is the total amount you can accumulate in pension savings over your lifetime without incurring additional taxes, currently set at £1,073,100 (2022-2023).

Of course, every individual's financial situation is different and will require a personalised approach. SavingTool.co.uk allows you to input your own salary, contribution rate, and starting age, to see how different scenarios could play out for you. It also allows you to test out different retirement ages, which can also have a big impact on your retirement fund. By using the website's pension calculator, you can see how small changes in your contributions or starting age can make a big difference in the long term.

How much do I need?

A common starting point to figuring out how much you need in an invested retirement pot is determining a pre-tax annual income that would sustain your desired lifestyle in retirement (using today's money, i.e., ignoring inflation).

Using this number, combined with a predicted withdrawal rate (rate that you opt to withdraw from your retirement pot), growth rate (rate that you expect the retirement pot to achieve in returns, after inflation), retirement age and fees, it is possible to estimate how much you need.

The How Much Do I Need Calculator allows you to supply these and get an insight of how much you need to achieve that, and how your retirement pot might look over time.

Try the How Much Do I Need calculator to get instant retirement insights.