Why a Stocks and Shares ISA Should Be Part of Your Investment Portfolio

Are you tired of watching your savings collect dust in a traditional savings account? It's time to consider a stocks and shares ISA as a way to potentially grow your wealth over time. These ISA accounts offer a range of tax benefits, making them an attractive option for UK residents looking to invest their money.

One of the biggest advantages of stocks and shares ISAs is the tax benefits they offer. The returns on your investments are not subject to capital gains tax, and any dividends you receive are also tax-free. This can make a significant difference in the amount of money you earn on your investments over time.

To understand the potential of stocks and shares ISAs, let's compare it with a typical cash savings account. For example, if you have £2,500 in a savings account that offers a 2.5% interest rate, after one year, your investment will be worth £2,562.50, a gain of £62.50. While this may seem like a small return, it doesn't even account for inflation which means that in real terms, you are probably losing money. Now, let's compare this with a stocks and shares ISA: if you were to invest that same £2,500 in a diversified portfolio of stocks and shares and earn an average return of 7% per year, after one year, your investment would be worth £2,675, a gain of £175. That’s a 2.8x improvement, and it demonstrates the potential of stocks and shares ISAs to grow your wealth over time.

It’s important to understand that investing in S&S ISAs comes with a certain amount of risk, since you are purchasing financial securities, which are subject to market conditions. Returns are not guaranteed and keeping cash in a UK bank account may be the strategy of choice for the risk-averse (cash is guaranteed up to £85,000 under the FSCS bank protection rules). However, a global index tracker approach with S&S ISAs offers a high level of diversification, allowing investors to spread risk and potentially reduce the impact of any losses. Investors can also opt to invest in bonds as a lower risk option, which can often meet or exceed inflation.

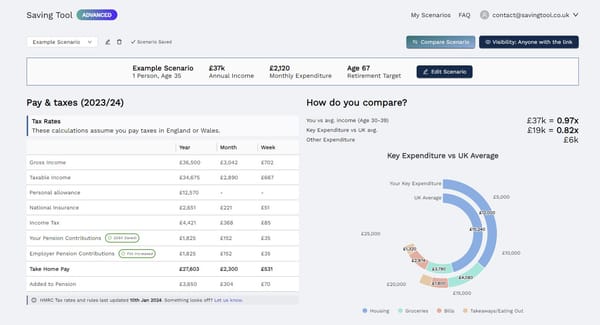

The SavingTool.co.uk simulation can be used to test out scenarios - how could your returns look when using a stocks and shares ISA in conjunction with other vehicles like pensions? At £20,000-per-year, the possibilities for compounding returns are large, and many UK taxpayers could benefit from using their allowance. Play around with retirement age, income, outgoings, pension contributions and budgeting changes to see how far your ISA could reach.

If you’re unfamiliar with S&S ISAs, it could be well worth doing your research today. Both MoneyHelper and MoneySavingExpert have great guidance on how to get started and what to be mindful of.

Beware that fees can make a significant difference (especially when accounting for compounding returns over the long term) - some providers may offer convenience and simplicity at the expense of higher fees, so it’s well worth doing your research about the different providers and funds you can invest in.